Thrifty Under Thirty: How to Budget and Save

Being a young adult is often one of the first times we have access to a large amount of money. Many of us have goals such as a big vacation, pursuing a degree, or even buying a car or house! Budgeting and saving can help use your new-found finances to turn your goals and dreams into reality.

Budgeting is the process of tracking expenses and saving for a specific goal or goals. One of the best ways to start budgeting is to create a monthly budget tracker. There are several budgeting apps and platforms that you can connect to your bank accounts, but you can also build your own budget tracker easily in Excel or Google Sheets.

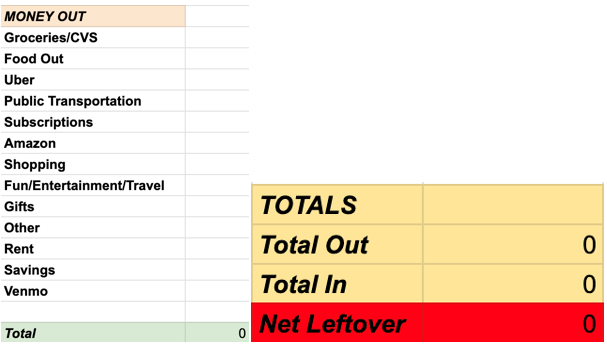

I built my own using Google Sheets. I categorize all the money that goes in and out of my checking account every month. I also separate the money I spend by my debit and credit cards, so I can see each individual purchase. Here is an example of what mine looks like:

Some people may also choose to have each individual purchase listed under each category for more detail, but I prefer just to have each category. On the first of every month, I go through all my finances from the previous month and add everything up to see my spending habits. This helps me see if I can put any leftover money into my savings account and see if there are any categories that I should cut back on to reach my savings goals faster.

I also like to reach my savings goals by having a recurring transfer into my savings account every month. I have added this to my monthly budget to continue to build my savings account, even when unexpected surprises come up.

To summarize, use a budgeting app (or create your own spreadsheet) to track your expenses, and automate your savings by scheduling recurring transfers into your savings account each week or month.