With 2024 right around the corner, the IRS recently announced several contribution limits for retirement accounts as well as increased thresholds for income tax

With 2023 right around the corner, the IRS recently announced several contribution limits for retirement accounts as well as increased thresholds for income tax

If you have worked for an employer where Social Security is not withheld, such as a government agency or an employer in another country, any retirement or

Despite it being such an expansive program, Social Security is relatively straightforward. You work for 40 quarters (or 10 years) and pay into the system. Once

The IRS has recently announced updated income limits for individuals who save into IRAs and Roth IRAs. Depending on your income, you can receive a full

Social Security benefits are a staple of funding one’s retirement needs. However, these benefits along with your life savings may not be enough to fund your

One would think that after years of contributing into Social Security, the benefits received would be tax-free. While to a certain extent they are, determining

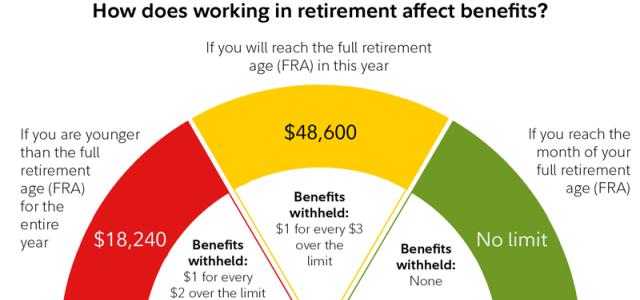

For working and retired individuals, Social Security is a major piece of the retirement puzzle. This stream of guaranteed income is an ever-changing program

As we move more into a cyber-centric world, so to comes the likelihood of fraud. Protecting oneself against these attempts requires constant vigilance. Social