Social Security Benefits While Working: How Are Your Benefits Affected

Social Security benefits are a staple of funding one’s retirement needs. However, these benefits along with your life savings may not be enough to fund your retirement or perhaps you never want to stop working which is why some individuals may choose to continue working and take Social Security benefits. While there is nothing that says you cannot do this, filing for benefits before you hit your Full Retirement Age (FRA) can reduce how much benefits you would receive if you are still working.

How Your Benefits Are Reduced

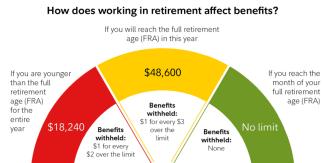

The SSA (Social Security Administration) sets guidelines on how much your benefits are reduced if you are still working and have filed before reaching your Full Retirement Age. The SSA will deduct a portion of benefits if your earnings from work go above their established threshold. (Note: Only earned income is considered. The SSA does not count pensions, annuities, or investment income.) Once you do reach your FRA, there is no limit on how much you can earn and will be eligible to receive your full Social Security benefit.

For 2020, individuals who earn more than $18,240 will lose $1 of annual benefits for every $2 that are earned about this threshold. For example, if an individual were to file for Social Security at age 62 with a $600/mo. benefit, their annual benefits would be $7,200 under normal circumstances. However, if this individual earned $25,000 for the year, the $6,760 differential ($25,000 - $18,240) would be considered in the calculation to reduce the benefits received; leaving the individual with $3,380 less in Social Security benefits.

In the year you reach Full Retirement Age, however, these guidelines change. The earnings limit is increased to $48,600 with $1 in benefits reduced for every $3 earned above this limit. Once you actually hit your FRA, this earnings limit will cease. For example, if an individual were to reach FRA in September 2020 but make $50,000 in January -August, the $1,400 differential ($50,000 - $48,600) will be considered for this calculation, leaving the individual with approx. $467 less in benefits.

The upside to all of this is that the reduced benefits are not lost forever. Once an individual hits Full Retirement Age, the monthly benefits will be recalculated and increased to account for all of the months in which benefits were reduced.

Planning Around Social Security

In general, most individuals would be better off filing for benefits once they hit their Full Retirement Age. While some situations call for different filing scenarios, it is strongly recommended that one consult with a financial advisor to analyze all options available to you. Filing for Social Security is a permanent decision that will affect the rest of your retirement and making a well-informed decision about this can significantly help with your retirement plan.

Weingarten Associates is an independent, fee-only Registered Investment Advisor in Lawrenceville, New Jersey serving Princeton, NJ as well as the Greater Mercer County/Bucks County region. We make a difference in the lives of our clients by providing them with exceptional financial planning, investment management, and tax advice.