You cannot time the market but you can time your retirement withdrawals. Sequence risk is the potential danger to periodically withdrawing funds from your

Using one’s home as collateral when taking on debt has its pros and cons. On the one hand, you may qualify for lower interest rates, but on the other hand, your

The triple tax savings benefits of Health Savings Accounts (HSA) make it an attractive savings option, not only for medical expenses but for potential

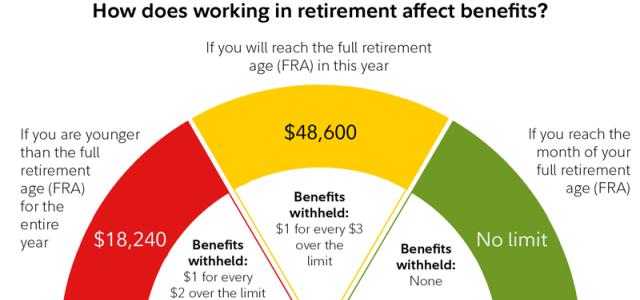

Social Security benefits are a staple of funding one’s retirement needs. However, these benefits along with your life savings may not be enough to fund your

Most tax planning scenarios fall under a gradual income system where incremental increases to income trigger minor tax consequences. Tax cliffs, however, follow

Earlier this year, the CARES Act eliminated Required Minimum Distributions from retirement accounts as a way to provide relief to investors by giving their

As part of our 4-part blog series (click to read Part 1 and Part 2), we went over common considerations and questions to ask yourself when planning for

In our 4-part blog series (click here to read Part 1), we went over common considerations and questions to ask yourself when planning for retirement. In this

Planning for retirement is a complex process. There are various factors to consider to confidently answer the simple question, “Do I have enough to retire?”

Over the past decade, the battle between growth stocks and value stocks have been one-sided. Growth has outperformed value, especially during 2019, which has