You cannot time the market but you can time your retirement withdrawals. Sequence risk is the potential danger to periodically withdrawing funds from your

The triple tax savings benefits of Health Savings Accounts (HSA) make it an attractive savings option, not only for medical expenses but for potential

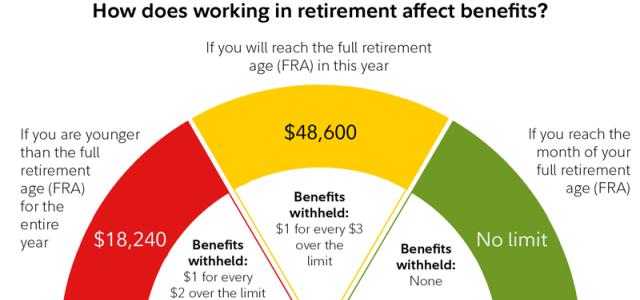

Social Security benefits are a staple of funding one’s retirement needs. However, these benefits along with your life savings may not be enough to fund your

As part of our 4-part blog series (click to read Part 1 and Part 2), we went over common considerations and questions to ask yourself when planning for

In our 4-part blog series (click here to read Part 1), we went over common considerations and questions to ask yourself when planning for retirement. In this

Planning for retirement is a complex process. There are various factors to consider to confidently answer the simple question, “Do I have enough to retire?”

Whether it is for greater investment flexibility, starting a new job, or retiring, rolling a 401(k) plan over into an IRA is usually a route that many

In order to help combat the COVID-19 pandemic, the $2 trillion+ federal aid package includes several provisions intended to help ease the financial burden that

There is no denying the tax-free benefits of Roth IRAs. Whether in the form of a direct contribution or a conversion, adding money into a Roth IRA is generally

For working and retired individuals, Social Security is a major piece of the retirement puzzle. This stream of guaranteed income is an ever-changing program

A few weeks ago, the SECURE Act was passed which has made some significant changes that can affect one’s financial planning strategies. Below are several