Being a young adult is often one of the first times we have access to a large amount of money. Many of us have goals such as a big vacation, pursuing a degree

Thrifty Under Thirty: An Introduction

Introducing Thrifty Under Thirty, a new blog series through Weingarten Associates about intelligent finances for young

With 2024 right around the corner, the IRS recently announced several contribution limits for retirement accounts as well as increased thresholds for income tax

Most investors consider their portfolio’s fixed income allocation as the safety net that can dampen equity volatility. While the primary focus for all investors

With the Fall season underway, current Medicare beneficiaries are reminded that Open Enrollment is now available for 2024 coverage plans. From October 15th –

Enacted into law back in 2021, the FAFSA Simplification Act set into motion major changes starting with the 2024-2025 academic year when filing the Free

When it comes to estate planning, many individuals update their documents that address their intentions – executors, inheritances, real estate, etc. However

Opening and funding a 529 plan for college expenses can be a great way to save for college along with the tax benefits – tax-free growth and tax-free

Dr Riley Moynes, an author and retired educator, published The Four Phases of Retirement: What to Expect When You’re Retiring. While the common question on

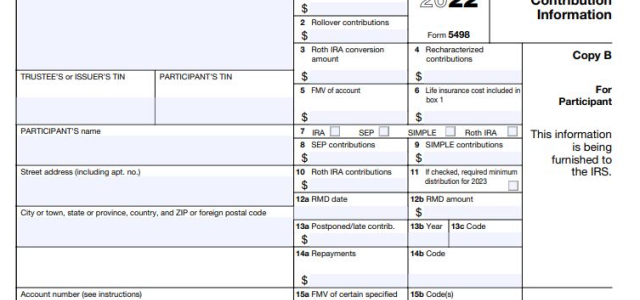

You may have received a 2022 Form 5498 from the IRS this month, after the tax filing deadline. Each year Form 5498 is issued in May. Form 5498 is an

With the number of interest rate hikes since 2022, investing in fixed income has become an attractive option. While inflation has cooled down since then, there

Part of a proper estate plan involves giving considerable thought to who will inherit your wealth once you pass away. Whether it is a person(s), charity, trust